Perspectives

Pediatric Health’s Growth Spurt: The Next Phase of Digital Disruption

As a nation we have fallen short on the promise of the American Dream, that every generation should enjoy a higher quality of life than the generation before it. US adolescents and young adults are in the midst of a health and care crisis. Over the past decade, major depressive episodes among adolescents increased by 52%. In the past three decades, the prevalence of childhood obesity has more than tripled in adolescents. One out of every five students reported being bullied. For millions, the future looks grim.

The status quo for children’s health must change. Despite being one of the most developed countries in the world, the US fails to deliver satisfactory healthcare for our children. Nearly 4 million children today lack health insurance and this figure continues to rise.

At the same time, pediatric healthcare expenditures are increasing and already outpace the growth in adult healthcare costs. Fueled by meaningful access and quality barriers, parents face substantial challenges when obtaining care for their children including provider shortages, rising healthcare costs, and a system that is poorly designed to meet the needs of diverse communities. Even for families that successfully receive care, children face a high prevalence of misdiagnoses, particularly for developmental delays, behavioral health conditions, and rare disease. COVID-19 has only exacerbated the systemic care gaps for pediatric support, driving declines in pediatric vaccination rates, inadequate school support for children with special needs, and greater pediatric behavioral health issues.

These systemic barriers lead many children to fall through the cracks of the healthcare system, particularly those from underserved communities. Children from low-income families experience outsized healthcare disparities with higher rates of asthma, mental health disorders, obesity, and infant mortality. Despite increased healthcare needs, vulnerable families are less likely to have access to traditional sources of medical care. In fact, more than half of children that visit the Emergency Department are from low-income households.

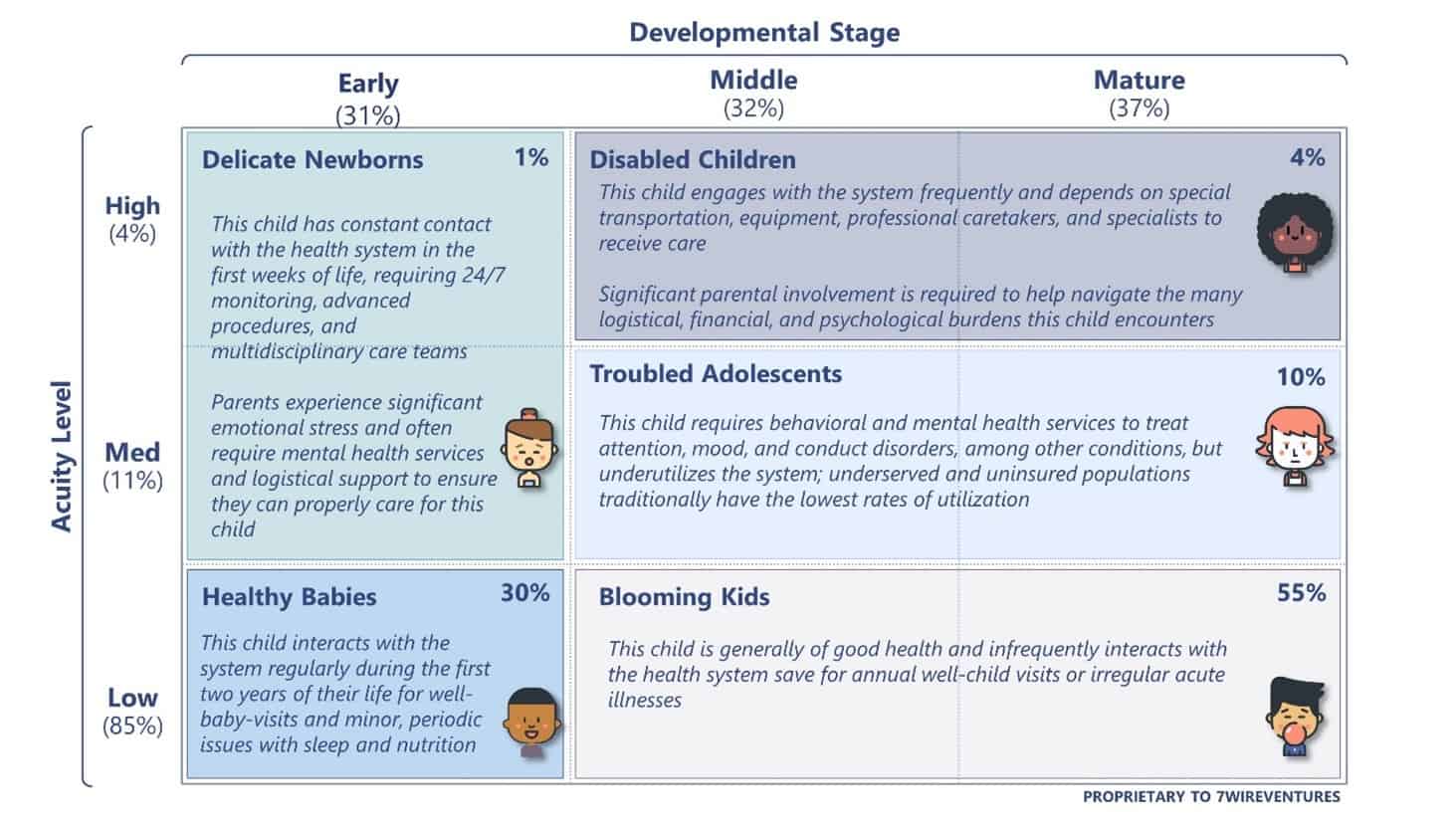

Children’s healthcare needs are far from homogenous. At 7wireVentures, we believe that healthcare solutions should be personalized based on the developmental stage and the acuity of care required for each individual. Across pediatric health, we have categorized children into five distinct segments: Delicate Newborns, Healthy Babies, Blooming Kids, Disabled Children, and Troubled Adolescents.

In response to the varying health needs of parents and children, digital health has emerged to disrupt the current one-size fits all system. As the needs of children are quite different from those of adults, solutions must be purpose-built for both the parents and children. Technology is facilitating personalized care delivery across all pediatric stages by enabling convenient and comprehensive care designed specifically for families. These solutions are being adopted by all healthcare stakeholders – providers, payers, regulators, schools, and employers.

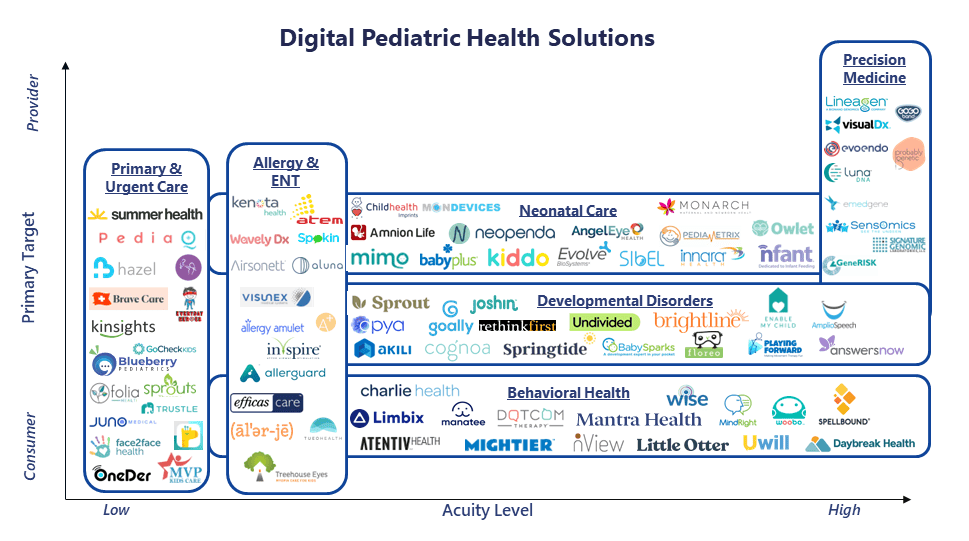

Digital Pediatric Health Landscape

The market for digital pediatric health solutions is relatively nascent, but investor interest is growing particularly in sectors such as developmental disorders. Private investment has fueled the development and expansion of new and existing solutions with close to $300M in total funding expected in 2021 relative to $205M in 2020.[1] The growth in funding is primarily attributed to (1) new companies that have emerged to address the unmet needs in pediatric healthcare (Brightline, Sprout Therapy, Kiddo) and (2) existing companies that have expanded to meet the demand during the pandemic (SchoolCare, Akili, Hazel Health,). As companies continue to scale, the median deal size has meaningfully expanded over the past few years.

At 7wireVentures, we view this growing pediatric health care market through the lens of six primary categories: Developmental Disorders, Behavioral Health, Allergy & ENT Solutions, Neonatal Care, Precision Medicine, and Primary & Urgent Care.

[1] Pitchbook

[2] Pitchbook

Developmental Disorders: Children with developmental delays require an ecosystem of multidisciplinary care support that is largely coordinated and managed by parents. This care journey creates a very stressful and hard to navigate experience for parents. In fact, a recent analysis revealed that 33% of parents with children with disabilities suffer from moderate depression compared to only 7% in parents of children without disabilities. Digital solutions seeking to alleviate the immense logistical, financial, and psychological burden on parents have generated the most investment activity in the pediatric health sector. Companies like Akili and Cognoa are developing digital therapeutics that enable earlier detection, diagnosis, and care for children with developmental conditions. Other companies are also building in-person and virtual care clinics to provide personalized support for specific developmental disorders. Companies like Positive Development and Sprout Therapy are leveraging tech-enabled platforms to connect children on the autism spectrum and their families with licensed therapists for customized treatment delivered in-person and online.

Developmental Disorders: Children with developmental delays require an ecosystem of multidisciplinary care support that is largely coordinated and managed by parents. This care journey creates a very stressful and hard to navigate experience for parents. In fact, a recent analysis revealed that 33% of parents with children with disabilities suffer from moderate depression compared to only 7% in parents of children without disabilities. Digital solutions seeking to alleviate the immense logistical, financial, and psychological burden on parents have generated the most investment activity in the pediatric health sector. Companies like Akili and Cognoa are developing digital therapeutics that enable earlier detection, diagnosis, and care for children with developmental conditions. Other companies are also building in-person and virtual care clinics to provide personalized support for specific developmental disorders. Companies like Positive Development and Sprout Therapy are leveraging tech-enabled platforms to connect children on the autism spectrum and their families with licensed therapists for customized treatment delivered in-person and online.

Behavioral Health: The increasing need for pediatric behavioral health support is driving parents to seek alternative care solutions. In the last decade alone, there has been a 52% increase in depressive symptoms among adolescents. However, parents are struggling to access appropriate mental health care as 70% of counties in the US do not have a single child psychiatrist. To improve access to pediatric behavioral health care, companies like Brightline are offering a comprehensive virtual care solution that allows on-demand access to clinically validated therapy, coaching, and support services. Companies are also developing digital therapeutics to deliver cognitive behavioral therapy (CBT) virtually. A prime example is Limbix – a prescription digital therapeutic that delivers a virtual, multi-week CBT-based program designed specifically for adolescents with depression. The increased utilization of digital platforms for pediatric behavioral health is alleviating capacity constraints and validating the efficacy of virtually delivered therapy interventions in children.

Allergy & ENT Solutions: Although food allergies cause an emergency room visit every three minutes, fewer than 50% of families receive anaphylaxis management counseling or carry an EpiPen. To address the lack of awareness and need for better medication management and food testing tools, a number of companies are leveraging at-home diagnostics and connected devices to reshape how common conditions are detected and monitored. For example, companies like Visunex and Kenota Health have developed convenient diagnostic tests that can be utilized by a broad set of clinicians at varying sites of care to safely and rapidly screen for pediatric allergies and ophthalmic conditions. Additionally, Allergy Amulet, a proprietary food allergen sensor, helps families avoid harmful allergic reactions by enabling children and parents to test foods in real-time for common allergenic ingredients.

Neonatal Care: Relative to other OECD countries, the United States ranks 33rd out of 36 countries and has an infant mortality rate 1.5x greater than the average member country. Infant mortality can be caused by several factors – sudden infant death syndrome (3.5K annual cases), genetic disorders and congenital anomalies (6% of live births), and racial disparities (49% higher rate of premature births for black women relative to non-black women). Digital solutions from neonatal wearables to whole-genome sequencing can improve access to high quality and affordable neonatal care. Companies like Owlet and Kiddo have developed neonatal wearables that track key infant vital signs including oxygen, heart rate, and sleep trends to provide actionable health insights to parents. Despite the tremendous health benefits of neonatal wearables, some companies are selling direct-to-consumer at price points greater than $300, a cost prohibitive purchase for many families that is limiting broad consumer access. Given the rising costs of infant hospitalizations, 7wireVentures sees a unique opportunity for digital health companies to partner with payers and providers to address the social, behavioral, and health factors that contribute to infant mortality and improve birth outcomes at scale.

Precision Medicine: Genomic testing and precision medicine solutions for rare diseases have an opportunity to transform pediatric care as 75% of rare diseases impact children. However, the development of pediatric wearable and biosensing technologies lags adult devices by 5 to 10 years. To bridge the technology gap, several companies are developing digital solutions that apply precision medicine to pediatric care. For example, Lineagen’s genetic testing technology can detect hundreds of pediatric conditions, enabling physicians to personalize care. With a genetic diagnosis parents can understand the true cause of a child’s autism and developmental delay, the risk of onset for other family members, potential co-morbidities, and expected prognosis. For example, Boston Children’s Hospital partnered with Emedgene to integrate the company’s genomics learning system and solve the challenges unique to pediatric rare disease research. By automating the research pipeline, the company was able to streamline and accelerate clinical care. Other companies like Astarte Medical have developed an AI-optimized genomic interpretation platform that delivers evidence-based insights from genomic data to create a real-time view of a preterm infant’s gut health.

Primary & Urgent Care: Children, particularly those from underserved communities, have traditionally relied on schools for primary care and mental health services. However, due to widespread school shutdowns related to COVID-19, many children did not receive the care they need as only 19% of school-based health centers utilize telehealth platforms. With parents spending an average of 30 hours on well-child visits during their child’s first five years of life, there is a clear opportunity to leverage digital solutions and turn schools and homes into new touchpoints for healthcare. 7wireVentures portfolio company SchoolCare, for example, is a healthcare platform that virtually connects K-12 schools, families, and healthcare providers to develop a holistic view of a child’s health history and status, and ultimately, enabling Managed Care Organizations to effectively identify and close gaps in care. Other companies like PediaQ are connecting parents to nurses for video visits or house calls for pediatric urgent care services through an easy-to-use mobile application.

7wireVentures Predictions

PREDICTION 1: Fueled by an increasing body of clinical evidence, adoption of pediatric virtual solutions across the full acuity spectrum will accelerate, with a particular emphasis on screening and diagnosis. Accelerated adoption will initially occur to address mental health concerns, behavioral conditions, and developmental disorders.

Several studies have demonstrated the efficacy of digital solutions for autism and pediatric behavioral health. In the mid-term, parents will become equipped with proactive digital screening solutions for their infants or young children from payers or providers. These self-service tools will ultimately become the new standard of care for a multitude of conditions. Additionally, virtual care solutions that provide highly specialized clinical expertise (e.g., NOCD, Equip, Brightline) will continue to gain adoption, particularly as these models deliver personalized care models that have increased efficacy when delivered inside the home. As the body of clinical evidence for these solutions expands, virtual care models may evolve to become the new standard of care for higher acuity populations, conditions (e.g., OCD, eating disorders), and treatments (e.g., exposure response therapy, family-based therapy).

PREDICTION 2: To support the parent workforce, employers will expand coverage of digital pediatric health solutions.

Prior to the pandemic, employers were slowly beginning to explore benefits designed for working parents, recognizing that such solutions result in higher rates of retention, advocacy, and effort. As COVID-19 compounded the responsibilities of parents, and drove millions of women out of the workforce, employer interest accelerated. As a result, organizations will look to add health focused solutions, particularly those that fill care gaps and ultimately improve the mental health, wellbeing, and productivity of their parent employee population. Parents of children with a behavioral health challenge are 50% more likely to suffer from a mental health condition. As such, employers will seek solutions that can support parents in caring for the wellbeing of their children and ultimately, alleviate the increased stress, anxiety, and fatigue affiliated with caregiver responsibilities.

PREDICTION 3: Bolstered by the growing body of data generated by digital solutions, healthcare stakeholders will increase expectations for hard ROI metrics for pediatric care delivery solutions and shift focus to partnering with outcomes measurement solutions.

Digital therapy applications and screening tools are collecting a robust set of longitudinal clinical, occupational, and behavioral data, which can provide objective measurements on a child’s progress and ultimately measure treatment efficacy. Such models are being rapidly adopted for pediatric developmental disorders where provider quality is particularly opaque. At-home therapy applications (e.g., Goally, Akili, Mightier) are being leveraged to deliver care while monitoring a child’s progress and ultimately, to benchmark treatment efficacy against similar populations. As payers continue to shift focus from volume to value, winning models will be those that generate hard outcomes data and construct value-based payment arrangements. Long term, payers will prioritize contracting with companies that provide real-time objective data to demonstrate efficacy.

In the wake of COVID-19, the pediatric healthcare market has never been in greater need for digital disruption. There is a pressing opportunity to both address the growing tsunami of pediatric behavioral challenges as well as to deliver high quality, convenient, and affordable care for children and adolescents. From remote monitoring to new sites of care, digital solutions have a unique opportunity to transform parents into Informed Connected Health Consumers who are better empowered to manage their child’s health.