Perspectives

Home is Where the Health Is: How Digital Health Can Make the Home a True Consumer-Centered Medical Home

As traditional sites of care shut down during the COVID-19 pandemic, consumers and providers were forced to find new ways to receive and administer healthcare. By May 2021, 88% of consumers said that they had used telehealth. Our outlook on how and where we received care was fundamentally transformed.

Even with the end of the nation’s Public Health Emergency, the shift in consumer preferences is expected to persist. This permanence reflects a growing consumer dissatisfaction with legacy systems that are characterized by high costs, suboptimal consumer touchpoints, and a lack of personalization. Today, 71% of consumers face major frustrations throughout the traditional healthcare journey, including long wait times and impersonal visits. Our nation’s healthcare workers are also feeling the strain, leading to suboptimal care that neglects the holistic needs of consumers. 95% of primary care physicians (PCPs) wish they could do more to help their patients stay well and prevent health problems and 54% often find themselves writing prescriptions or referring patients to specialists due to time constraints. Current estimates suggest little relief is in sight – by 2034 the U.S. is projected to have a shortage of 124K+ primary care and specialty physicians. A poor consumer experience coupled with inadequate care delivery has led to outsized healthcare spending and increasing disease burden. Today, nearly one out of every three dollars spent on healthcare is spent on hospital care and almost 50% of the population is living with a chronic illness.

Consumer demand for healthcare solutions that go beyond the four walls of the clinic and allow convenience and personalization from the comfort of one’s home is palpable. Since the pandemic, we’ve seen a 29% increase in the use of remote healthcare services among U.S. adults. Telehealth usage has also surged and stabilized at a 38x higher rate than pre-pandemic levels. In addition 60% of consumers have shared an interest in wanting a broader set of virtual health solutions. Aside from increased consumer demand, 58% of providers view telehealth more favorably, with 84% of physicians offering virtual visits.

Despite the prevailing tailwinds, we are still at the nascent stages of the shift towards innovative digital solutions that empower individuals to access healthcare from the comfort of their homes. That said, there is growing consensus acknowledging the limitations of the current healthcare delivery system. Moreover, health at home solutions have the potential to enhance the consumer experience and improve the quality, accessibility, and convenience of care across various stages of acuity. Digitalization is reshaping the healthcare industry as we know it, with innovations such as remote patient monitoring (RPM), at-home labs, and predictive analytics expanding the norms of care. Given the longstanding challenges in access, affordability, quality, and efficiency that the healthcare system has not been able to effectively solve, health at home solutions offer promise.

For consumers, receiving care in the home offers immense potential to receive convenient, high-quality care affordably. Averted downstream conditions, avoidance of unnecessary ED visits (by an estimated 19%), lower utilization of lab orders, imaging, and consultations, and reduced wait times are just a few of the many benefits these models boast. Hospital at home programs that enable consumers to receive acute care in the comfort of their home have proven effective in reducing complications and readmission rates while cutting the cost of care by 30% or more, driven by cost savings from reduced excess inpatient days, fewer complications and lower overhead costs. Such solutions can also enable care for hard-to-reach populations such as low-income groups, residents of rural areas, as well as the elderly, with studies finding an increased use of virtual care among these groups year over year. In recognizing the merits of health at home solutions, we are seeing an increased consumer demand for such solutions with 61% of survey respondents and 51% preferring telemedicine for prescription refills and minor illnesses and 2 in 3 adults in the U.S. sharing a preference for home healthcare relative to going into a provider’s office.

For healthcare providers, health at home solutions leveraging remote monitoring and diagnostic tools can enable clinicians to have an informed view of consumer health when treating patients virtually. These tools open the door to more frequent access of consumer biometrics and vitals, enabling more accurate and timely diagnoses and treatment than is feasible with traditional in-person approaches. By effectively automating health data capture, such solutions also support more efficient care delivery for heavily strained healthcare systems, reducing clinician burnout by decreasing some of the administrative responsibilities that currently take a toll on providers and limit their ability to work at the top of their licenses. For payers, a digital health ecosystem that expands into the home can allow for deeper partnership with providers and more engagement with consumers, meaning higher touch points and greater capacity for information gathering, allowing payers to enhance their value proposition and improve member experience.

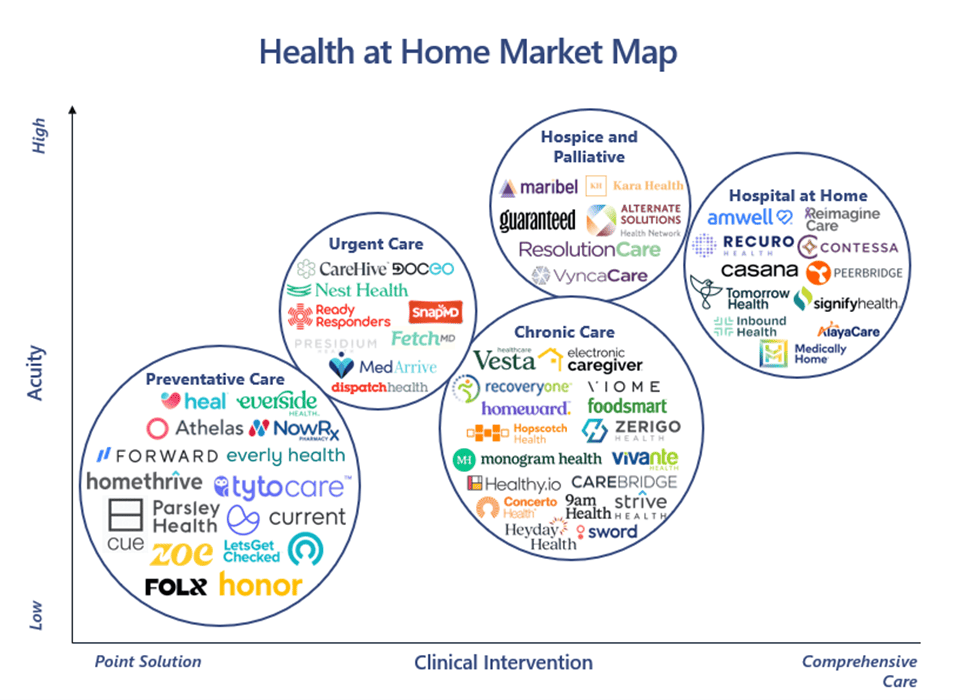

At 7wireVentures, we believe that there exists a massive opportunity in leveraging technology to generate positive outcomes by delivering care in the home. Today, we are seeing several players come to market with innovative products and platforms designed to improve health at home. These range from preventative measures to urgent care to even replicating the hospital experience at home, using enabled technologies such as remote monitoring capabilities, at home diagnostic tools, as well as disease and medication management platforms. However, these solutions are just a drop in the bucket of the opportunity that exists within the health at home space. With greater regulatory certainty, openness to reimbursement, and concerted effort to expand access to care to underserved populations, the healthcare system can begin to unlock the home’s true potential.

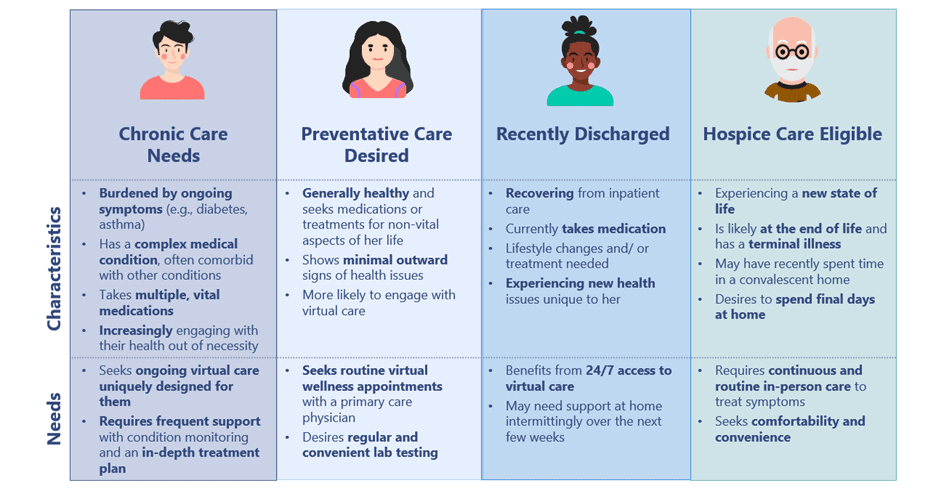

The breadth of consumers needing improved health at home solutions is notable, though such needs vary based on their acuity of care. To outline these groups, we categorize consumers into four distinct segments: Chronic Care Needs, Preventative Care Desired, Recently Discharged, and Hospice Care Eligible.

Proprietary to 7wireVentures

The unique characteristics of these consumer segments demonstrate varied intensities of care required in line with acuity levels. Through targeted and specific need-based solutions, the user health journey can be reimagined to provide more personalized care that truly takes a whole person approach, while offering greater convenience and outcomes. Ultimately, by receiving care at home, these consumers can truly experience patient-centered care.

The Health at Home Landscape

Investment in health at home solutions has meaningfully accelerated in response to the pandemic, reaching $4.7B in 2021 from $2.2B the previous year. While activity in 2022 was relatively muted compared to prior years, stakeholder interest in health at home solutions continues.

Though in its broadest sense, health at home companies can be considered as any that allow the consumer to interact with healthcare providers or solutions outside the four walls of the clinic, at 7wireVentures, we have more narrowly defined these companies as those that truly extend clinical capabilities into the home to elevate care. We have categorized these solutions across five primary categories: Preventative Care, Urgent Care, Chronic Care, Hospital at Home, and Hospice and Palliative Care.

[1] Pitchbook

Preventative Care

A key merit of health at home solutions is the ability to tilt the focus of health towards early diagnosis, monitoring, and thus prevention, yielding lowered costs and improved outcomes as well as greater health equity and access. Preventative care approaches when coupled with convenient and virtual home-based models have proven to be effective forms of care delivery for even the most complex patients. Further, there is an untapped opportunity to expand diagnostics and testing into the home as 70% of today’s medical decisions require lab-work or diagnostics. To tackle this, we’re seeing the emergence of direct-to-consumer companies that provide novel solutions focused on delivering quality preventative care at home in highly convenient manners. Cue Health, for example, is responding to this market demand with the rapid delivery of at-home testing kits and on-demand telehealth services, revolutionizing the way consumers access diagnostic testing at home. Further, companies like Forward and TytoCare are combining virtual care delivery with biometric screening tools to identify and track changes in health status early on.

Employers too recognize the value of preventative care, though they often find that simply providing health benefits is not enough. The reality is more nuanced, with nearly 20% of the U.S. adult population having to double up as caregivers outside of work, providing unpaid care to an adult over the age of 50. Such caregivers spend close to 20 hours a week delivering such care, fueling their burnout and lower productivity. Portfolio company Homethrive addresses this complex reality by providing on-demand resources to support working family caregivers in their homes, helping them reduce over 16 hours of time spent on caregiving each week. Much like Homethrive, FOLX addresses the nuanced lived experiences of its members through a thoughtful, purpose-built model. FOLX connects employees to a diverse network of queer and trans specialized clinicians, offering highly curated LGBTQ+ care, including virtual primary care, mental health support, access to a non-stigmatizing community of peers, as well as vital medications delivered to the home.

Making preventative care easy to access on demand within the home is a welcome step towards changing the way we approach healthcare delivery in the U.S.

Urgent Care

Since 2019, urgent care patient volume has increased by 60%, with 26% of urgent care centers seeing more than 60 visits per day in 2021 (compared to 11% in 2019). In the face of increased pressure on existing urgent care facilities, companies have realized the value of bringing urgent care into the home, providing remote/in-home access to healthcare providers and treatment. This not only eases supply, but improves patient experience, and aligns with their preference to stay out of crowded EDs and access care at home instead.

MedArrive, another member of the 7wireVentures portfolio, has been able to lower ED utilization by 20% and has achieved a 30% hospital visit reduction using its network of 50,000 field providers to deliver rapid care to those who need it. The company does this through its virtual platform offering its users access to a network of highly trained field providers. The platform integrates health plans, providers, and patients with EMS professionals (EMTs and paramedics) as well as MAs, RNs, and community health workers. Moreover, aside from increasing access to urgent care through sheer solution convenience, MedArrive can leverage comprehensive Social Determinants of Healthcare identification and make a connection to community resources, thus catering to underserved communities in a more impactful way.

Chronic Care

Chronic diseases are escalating in the U.S. and constitute one of the leading drivers of the nation’s $4.1 trillion in annual healthcare costs.

Often, chronic illness requires frequent in-person visits, making accessing care an inconvenient and time-consuming burden for many. Companies such as Vivante and 9amHealth address chronic conditions through full-stack virtual clinics, providing customers with services such as personalized, on-demand care, symptom tracking, and at-home testing, catering to gastrointestinal issues and diabetes respectively.

Rural Americans living with chronic conditions experience access barriers even more acutely, ultimately leading to deleterious health disparities. These 60 million Americans face significantly higher odds of dying prematurely from chronic illnesses such as heart disease and diabetes than their urban counterparts, and this disparity is projected to only increase.

Homeward delivers a hybrid virtual and in-person model of care for aging rural communities in need of primary and specialty care services. To accommodate the specific needs of rural communities, the company’s telehealth and remote monitoring services rely on cellular network connections instead of broadband internet given the limited access to high-speed internet that some rural counties experience. Further, the company’s in-person care services are delivered through mobile units that can be accessed by members in central community-based locations, such as church or library parking lots – effectively meeting the consumer wherever they feel most comfortable receiving care.

An advantage conferred by solutions that expand chronic care management into the home using technology is the ability to gather health data more frequently and use it to predict adverse events and treat consumers in a more personalized manner. Monogram Health takes advantage of this opportunity, using remote biometrics monitoring and algorithm-based risk prediction to help manage chronic kidney and end-stage renal diseases. Personalized care planning and predictive analytics further help patients smoothly transition to additional services such as dialysis, palliative care, or preemptive kidney transplants if needed, driving better health outcomes in the process.

Hospital at Home

Another category of health at home solutions includes creating a “hospital at home” environment, where the quality and needs of care align with what can only otherwise be achieved in a hospital setting. Bringing this level of care to the home frees up valuable beds for other patients but also enables quicker and more convenient care for the patient. Supported by custom referral pathways and bi-directional data flows, companies can provide a full substitute for acute hospital care to the patient.

Further, a major challenge facing hospitals is high readmission rates (estimated to be 15% though varying greatly by location and condition), so much so that the government is penalizing hospitals for them. This can occur due to a variety of reasons including failure to identify post-acute care needs or lack of timely follow-up care. Bringing hospital quality services to the home through health at home solutions can address some of these challenges. Recora, a virtual cardiac rehab platform, is a strong example of this category of care. The company aims to move rehabilitation beyond the traditional bounds of the standard 12 weeks of care management and offer virtual and RPM tools including a tablet and blood pressure monitor along with 24/7 access to a care team. The convenience it offers to patients has contributed to its high program completion rate of 87%, higher than the national average of 26%. Its hospital readmission rate too is only 11% and lower than the national average.

Hospice and Palliative Care

Given the distinct challenges and burdens placed on accessing healthcare for those experiencing a life-limiting illness, at home hospice and palliative care solutions possess huge potential for improvement in condition management as well as freedom of choice and convenience that patients deserve during this phase of life. Further, the financial demands placed in these last few months can be enormous. Employing home-based care can bring down the costs for the individual and their families, while also improving the quality of care received.

Companies addressing such problems include Guaranteed Hospice, which reimagines hospice care at home through the integration of technology to provide better care for those that need it most. The company uses technology to deliver more personalized care that can provide more patient-appropriate, whole-person support. Users can access 24/7 care to psychological services, a chaplain, a dietician, and medical staff. This makes for greatly enhanced symptom management and a reduction of psychological stress as consumers can access care where they are and when they need it.

7wireVentures Predictions

PREDICTION 1: As the industry shifts towards more home-based care offerings that offer a lower-cost site of care compared to traditional in-person care settings, demand for such solutions will grow, thus setting in motion a virtuous cycle towards value-based care.

Growing demand for value-based approaches will only further promote the ubiquity and acceptance of at-home approaches and lend favorably towards models that keep providers accountable for cost and outcomes. We will also see a need for greater integration of typically disparate health at home solutions and infrastructure investments in technologies that integrate with current EMR as synchronized care, aggregated data collection, and the identification of gaps in care become paramount. These trends will be felt across care settings, specialties, and modalities, with surviving solutions being those that are able to effectively adapt towards integration of existing disparate solutions clinician types, specialties, and modalities.

PREDICTION 2: As demand for healthcare continues to outstrip supply and access to preventative care in traditional settings is constrained and costly, incumbent healthcare stakeholders will expand offerings into the home.

In the face of rising competition, the acquisition of complementary assets to expand the remit of care will be critical to company survival, and traditional healthcare stakeholders may partner with non-traditional players, e.g., digital health companies, for growth. CVS, Amazon, and Walmart have notably made several acquisitions in the healthcare segment in recent years (acquiring Signify Health (technology-enabled healthcare services delivered in the home), One Medical (in-person and virtual primary care), and MeMD (telehealth), respectively). Traditional players too are partnering to expand at-home member offerings. Earlier this year, Memorial Hermann Health System announced a landmark joint venture with AccentCare, one of the largest providers of tech-enabled home health and hospice service providers in the country. The partnership will allow Houston’s largest health system to significantly advance its capability to innovate and optimize care in the home.

Partnerships such as these will be crucial towards the development of sustainable home-based solutions. It is predicted that new primary care models from non-traditional players such as retailers, payer-owned providers, advanced primary care disrupters, and concierge providers could capture as much as a third of the U.S. primary care market by 2030. Moreover, it is expected that retailers alone will account for 5-10% of total primary care by 2030, perhaps even outperforming traditional primary care providers.

PREDICTION 3: Given the increased ability to collect broader sets of user data, providers will be better equipped to develop deeper insights into consumers and thus take a whole-person, personalized approach to care delivery.

Such data gathering will enable the use of employing predictive analytics towards providing more proactive, personalized care and will also mean more of the focus can be shifted to earlier stage, preventive interventions, reducing costs further down the line. While companies such as Netflix and Starbucks are already using personalization to transform their business, the healthcare industry is just embarking on this journey. Truly effective personalized healthcare will combine not only health metrics, but the social determinants of health as well. This would mean building a better understanding of the consumer, while also using those insights to tailor provider interactions in the most impactful way. Ultimately, as our trend towards greater personalization continues, consumers will benefit from more informed, appropriate, and holistic healthcare delivery.

We have conviction that health at home solutions can address major challenges impacting the healthcare industry, empowering consumers to gain greater agency and access to high-quality care in the process while addressing the inequalities and inefficiencies impairing the industry today. To truly realize the potential offered by the health at home disruption, multi-stakeholder collaboration across payers, providers, and policymakers is needed, and when successfully leveraged, it offers the potential for a redesigned, more equitable, and more sustainable approach to healthcare moving forward. Through the continued expansion of digital technologies within healthcare, there is a meaningful opportunity to place the home right at the center of health and care.