Perspectives

Digital Health: The Ammunition to Tackle the New Pandemic of Mental Health

A long year has passed since the first confirmed case of COVID-19 was reported in Washington state, transforming our vibrant world to one colored with curfews, business closures, and lockdowns. Now, as nearly 100 million Americans have rolled up their sleeves to receive a vaccine, the country has started to experience a long-forgotten feeling: hope. Envisioning a world without COVID-19 finally seems plausible.

However, fighting the physical risks of the virus was just the first battle required to win the COVID-19 war. The devastation of the past year – millions of lost lives, financial strife, and unprecedented social isolation has laid the foundation for a second pandemic that has long been bubbling beneath the surface. To fully combat the devastation caused by the coronavirus, the world must again mobilize our troops for the next battle: tackling the surge in mental health conditions.

Unlike the first pandemic, there is no vaccine to address the consequences of the growing behavioral health pandemic. Today, 4 in 10 U.S. adults reported symptoms of anxiety and depression, nearly quadrupling the pre-pandemic prevalence. For a significant portion of the population, the rise in mental health issues provoked or exacerbated by the pandemic are anticipated to persist for years to come.

However, the current system for delivering behavioral healthcare is ill-equipped to support the projected tsunami of mental health cases in 2021. Consumers in need of behavioral health treatment have faced significant barriers to care, both during and preceding the onset of COVID-19. While stakeholders across the healthcare landscape are investing substantial resources in addressing the mental health crisis, consumers face considerable impediments to accessing care including stigmatization, a shortage of behavioral health specialists, and insufficient insurance coverage.

Fortunately, a plethora of digital health startups have emerged to improve the current behavioral health care delivery model and meet the growing health needs of the population at scale. Such solutions are empowering consumers to overcome existing barriers to care by expanding access, reducing costs, minimizing stigmatization, and improving outcomes through convenient and personalized care.

Digital Behavioral Health Landscape

The market for behavioral health solutions is robust and growing as investment in the space has fueled the development and expansion of new and existing solutions. While private investment in digitally-enabled behavioral health care models has steadily increased since 2010, the past three years have been characterized by a significant surge in funding. Total private investment in digital behavioral care companies in 2020 surpassed $1B and more than tripled the funding total just two years prior.[1] The growth in funding is primarily attributable to larger, later stage investments in digital behavioral health companies that have matured throughout the past decade. COVID-19 in particular generated an increased need for digitally delivered behavioral health solutions, and as a result, several later-stage companies such as Headspace, Mindstrong, and Lyra raised mega rounds ( $100M+), signaling interest from a broader private funding market.

As a result, median deal size has also grown, nearly tripling from 2017 and exceeding $3M in 2020. While this growth is an indicator of market maturity, the pipeline for early-stage smaller investments remains strong; for some segments of the market, we are still in the early innings.

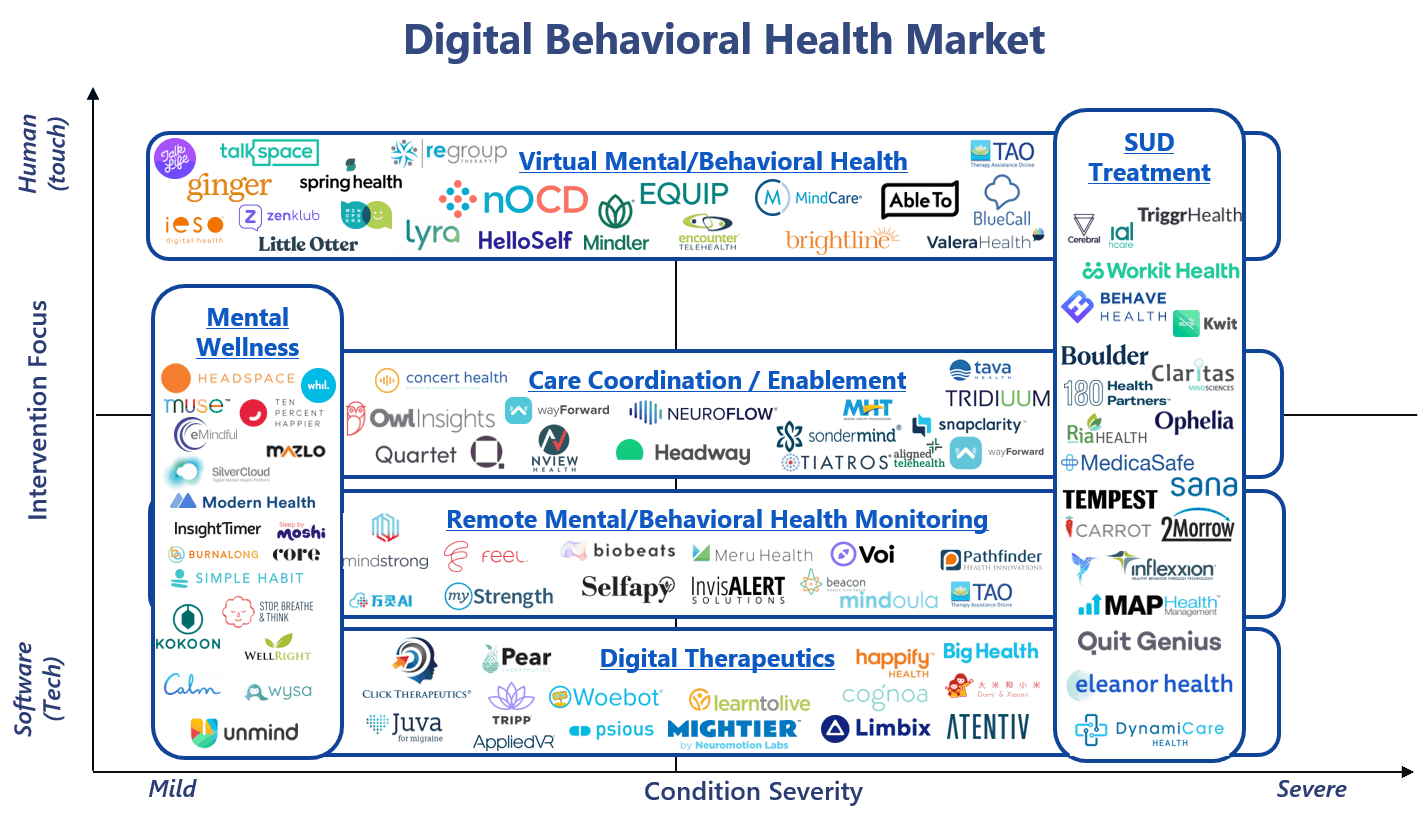

At 7wireVentures, we view this growing digital behavioral health care market through the lens of six primary categories: Virtual Mental Health, Mental Wellness, Care Coordination and Enablement, Remote Behavioral Health Monitoring, Substance Use Disorder, and Digital Therapeutics.

[1] Pitchbook data

Pitchbook data

Virtual Mental Health: COVID-19 has drastically accelerated virtual care adoption, particularly in the behavioral and mental health space. Many employers expanded behavioral health benefits in an effort to support employees through the pandemic. For example, virtual behavioral care provider Lyra Health reported a 200% increase in employer customers offering mental health focused benefits. Simultaneously, the pandemic exacerbated higher acuity behavioral health disorders, inciting increased demand for specialty virtual mental health solutions. 7wireVentures portfolio company NOCD, for example, which specializes in personalized telehealth services for obsessive-compulsive disorder (OCD), reported doubling their therapy sessions since the start of the pandemic. Given relaxed regulations around telehealth, increased consumer and provider comfort with virtual care, and the projected shortage of behavioral health providers in the U.S., both consumers and providers will rely more heavily on virtual channels to treat behavioral health issues in the future.

Mental Wellness: COVID-19 has also accelerated the adoption of mental wellness solutions, particularly for employer-centric platforms that combat increased levels of stress and burnout. Mental wellness solutions offer many benefits to consumers, including a reduction in reported stress levels at work and increased mental clarity. Companies, such as Spring Health, engage with employers to provide employees with tailored mental health care that includes offerings from meditation to direct engagement with a clinician. Additionally, several mental wellness solutions have strategically crafted partnerships with employers to offer a more holistic approach to broader behavioral health needs. Calm is one such company offering meditation and sleep support to individuals and as a benefit to employees through employer-based contracts.

Care Coordination and Enablement: Payers and providers are increasingly seeking solutions to offer a connected, longitudinal, and holistic consumer experience. As a result, care models are moving towards a more integrated approach when it comes to treating the behavioral and physical needs of patients. By delivering an integrated and coordinated approach to care, organizations providers have demonstrated success in reducing downstream costs associated with emergency room utilization and hospital admissions. One example of a solution is Quartet, which offers a platform that proactively screens and engages patients who may need access to behavioral health care, enabling referrals, and matching individuals to the optimal point of care. Given the growing demand for behavioral health services and the data supporting the importance of integrating mental and physical health, care coordination and enablement will play an integral role in the behavioral healthcare landscape.

Remote Behavioral Health Monitoring: By employing remote monitoring solutions that enable the passive collection of key patient data, providers are able to deliver personalized interventions and supplement traditional services to deliver always-on support. Mindstrong is one such company that leverages a digital platform to measure biomarkers that provide insights around brain function from data captured passively and continuously. The company’s data enables clinicians to conduct evidence-based interventions while providing personalized support to consumers. Meru Health is another example of a company that uses remote monitoring to treat and support consumers who struggle with depression, anxiety, and burnout. Increased consumer willingness to engage in remote monitoring of behavioral health symptoms suggests that remote monitoring solutions will continue to experience rapid adoption.

Substance Use Disorder: COVID-19 has led to a significant increase in rates of substance use disorder, further exposing systemic shortfalls. Digitally enabled substance use disorder treatments have gained substantial traction during the pandemic as a mechanism for filling gaps in access to care. Additionally, regulatory approval for digital prescription of MAT therapy has accelerated the adoption of virtually delivered treatment for substance use disorder. Companies such as Workit Health have demonstrated successful outcomes with telehealth-based medication assisted therapy treatment for individuals suffering from opioid and alcohol addiction. Other companies, such as Eleanor Health, have proven strong clinical outcomes by leveraging a whole person focused treatment program with a hybrid in-person and virtual care delivery model.

Digital Therapeutics: Digital therapeutics are a growing category of tech-enabled care that uses clinically validated software to treat disease. Following the FDA’s decision to temporarily waive the 510(k) clearance in an effort to get digital health tools in the hands of consumers, 28 digital health products received clearance in the first half of 2020, with the majority focused on behavioral health. Pear Therapeutics led the way in the sector, focusing on developing digital therapeutics in substance use disorder, opioid abuse disorder, and sleep disorders. Click Therapeutics is also a notable player, recently securing $300M from Otsuka Pharmaceuticals to co-develop a new major depressive disorder digital therapeutic. The growing evidence around the efficacy of digital therapeutics, particularly as a mechanism for supplementing traditional outpatient care, suggests there is more to come in the development of these cost-saving solutions.

7wireVentures Predictions

PREDICTION 1: Prevalence of higher acuity mental health disorders will continue to rise, inciting payers and providers to partner with digital solutions to meet increased demand.

Treatment of higher acuity mental health disorders has shifted from primarily in-person care delivery models to digital models of care as a result of the COVID-19 pandemic. Digital treatment models have proven to be effective in delivering high-quality care, increasing the likelihood of long-term adoption. As the prevalence of high acuity behavioral health conditions continues to rise, so will the demand for solutions that can effectively screen and treat these patients. Payers and CMS are expected to expand coverage of digital care models that serve this higher acuity population beyond the pandemic to meet this growing need. Additionally, payers will look to contract directly with companies that employ narrowly focused care models with clinical expertise for treating particularly high cost and hard to manage populations. 7wireVentures Strategic Limited Partner Horizon Blue Cross Blue Shield of New Jersey is one example, who recently contracted with NOCD to provide members access to specialty virtual OCD treatment. This care model shift will increase consumer access to clinicians with expertise in treating particular conditions.

PREDICTION 2: The integration of behavioral health care within digital solutions for chronic care management will become widespread.

With over two-thirds of Americans who battle behavioral health conditions also reporting one or more comorbidities, chronic care providers will need to address the nuanced behavioral health challenges within the context of specific diseases. Given the high costs associated with behavioral health conditions, chronic care platforms will prioritize the integration of mental health to better manage the whole person and capture greater cost savings. While some players will elect to build behavioral health modules into existing platforms, many will enter the market through strategic acquisitions. Livongo, for example, integrated behavioral health services to the broader platform through the acquisition of MyStrength. Given the growing emphasis on offering a holistic approach to care, we at 7wireVentures believe that there will be more widespread integration of behavioral health services into physical health solutions across digital health platforms.

PREDICTION 3: Consumers will increasingly rely on their employers to provide digital solutions for behavioral health.

Employers have increasingly recognized the importance of their employee’s mental health for productivity, retention, cost savings, and health outcomes. The proliferation of behavioral health solutions has overwhelmed many consumers, shifting the expectation of the employer role from benefits aggregator to curator of reliable solutions and customized recommendations. Employers will increasingly integrate digital health solutions such as Ginger, Wayforward, or Modern Health into company benefit packages that offer multiple behavioral health care options in one aggregated platform. In line with this benefit expansion, employers will increasingly expect digital health solutions to substantiate the business case with proven outcomes and cost savings data prior to establishing or deepening partnerships.

PREDICTION 4: Payers will demand rigorous outcomes data for digital substance use disorder solutions as virtual-only care models for addiction continues to rise.

Regulatory barriers for telehealth in addiction care were lifted during the COVID-19 pandemic, making way for the adoption of hybrid and virtual-only care models, particularly for MAT-therapy. The rapid surge in cases of substance use disorder as a result of the pandemic overwhelmed an already strained system and fueled a new bill (CARA 2.0) to permanently allow healthcare providers to use telehealth in MAT programs. In the face of severe gaps in access to care, virtual-only or hybrid models will surface as the clear market winners given the companies’ abilities to provide comprehensive treatment and collect longitudinal data to inform highly personalized real-time clinical decisions. Demonstrating clinical efficacy through rigorous outcomes data will be integral to the success of these models as payers look to partner with a singular, end-to-end solution.

While innovation in behavioral health care delivery has accelerated in the face of the enormous challenges of the past year, there is still a pressing need to move closer towards a world where behavioral and physical health are treated holistically rather than in parallel. Digital health has an opportunity to close existing gaps in access to care and equip Informed Connected Health Consumers to manage their mental health needs at scale. While digital health solutions alone will not win the battle against rising mental health disorders following the pandemic, the widespread adoption of solutions from both consumers and key healthcare stakeholders will provide powerful ammunition for combatting the long-lasting mental health needs to come.