Perspectives

Spotlight on Consumer-Directed Technologies: 7wireVentures 2022 Digital Health Predictions

While the pandemic in 2020 presented an unparalleled number of challenges for the US and the world, 2021 further tested the resilience of our healthcare system and front-line workers. A growing number of coronavirus variants, rising provider shortages, clinician burnout, and widespread misinformation have created a new concoction of healthcare complexities for our nation to address.

Yet at the same time, 2021 was a year of unprecedented innovation. The world approved a new vaccine in record time, for which 484 million doses have been delivered to US adults and children over 5 years old. Several regulations were amended such as permitting telehealth care across state lines and the use of novel solutions under the FDA’s emergency use authorization, aiding in improving access to care, curbing the spread of the virus, and keeping individuals out of traditional health system settings. Throughout the past year, digital health has continued to be a leading tool for providing a safe, reliable way for consumers, providers, and caregivers to access efficacious care.

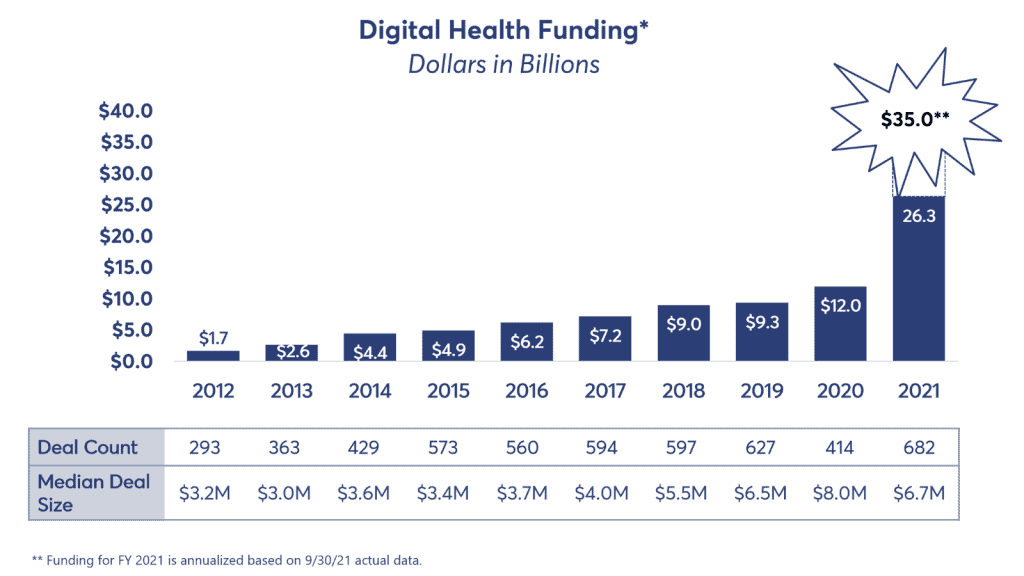

With digital health leading this innovation, investment momentum has accelerated in the market. 2021 funding vastly exceeded 2020 and reached unprecedented highs as new investors flocked to support compelling businesses, and round sizes expanded across all stages. More than 680 digital health companies received venture funding through Q3 2021. As a result, digital health has achieved unparalleled adoption from stakeholders across the ecosystem, creating a strong foundation and accelerant for the industry.

At 7wireVentures, we believe that in 2022, the spotlight will be on consumer-directed technologies and services that are improving the health and care experience for all. Our predictions for the new year include:

At 7wireVentures, we believe that in 2022, the spotlight will be on consumer-directed technologies and services that are improving the health and care experience for all. Our predictions for the new year include:

#1 One Size Does Not Fit All – Companies will prioritize understanding consumer values, attitudes, and opinions to personalize care and drive behavior change

In the new year, solutions will be increasingly tailored and personalized to the individual consumer. As digital health companies compete for consumer attention, key players will look to understand consumer’s psychographic profiles, medical history, attitudes and behavior, and even genomic data to deliver a superior consumer experience. Over time, we expect solutions that prioritize consumer preferences holistically, such as Transcarent, or deliver highly personalized and precise care like NOCD and Equip Health, will continue to see increased market interest.

#2 Reaching New Customers – Solutions will expand offerings through M&A to attract new patient populations or expand value-based services to command larger multiples

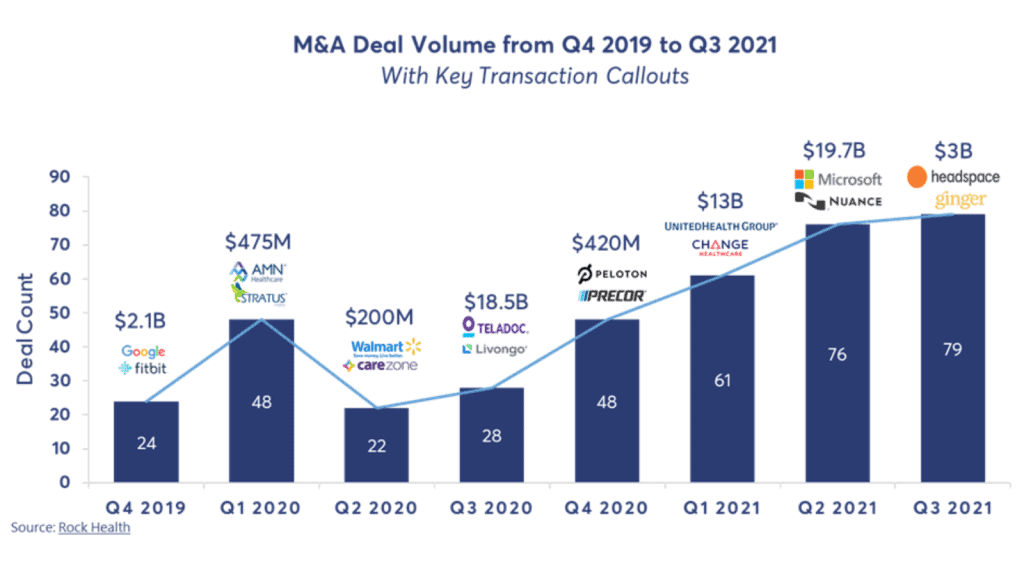

Since the $18.5B merger of our portfolio company Livongo with Teladoc, digital health M&A activity has flourished. To date there have been well over 220 notable digital health M&A deals in the sector throughout 2021. 2020 saw significantly less M&A volume with 146 transactions. Notable deals from the past year include the $3B merger of Headspace and Ginger and UnitedHealth Group’s $13B merger with Change Healthcare. While the majority of acquirers are still other digital health companies, other players include private equity funds, health systems, health plans, and Big Tech organizations, such as Microsoft’s $19.7B acquisition of Nuance.

In the new year, well-funded players will continue to be positioned as acquirers and turn to M&A to expand their product and service offerings to reach new patient populations or to expand their services, presenting one of the many attractive exit pathways for current and future investments.

In the new year, well-funded players will continue to be positioned as acquirers and turn to M&A to expand their product and service offerings to reach new patient populations or to expand their services, presenting one of the many attractive exit pathways for current and future investments.

#3 Where Tech Meets Touch – Companies and stakeholders will look to reimagine care through hybrid virtual and in-person models

While technology is a transformational tool that can and should be leveraged to scale clinician workforces and improve how consumers receive care, technology alone is not always sufficient. Going forward, companies will develop solutions that provide hybrid models of care to bridge the virtual care gap by connecting virtual care teams with hands on care.

Additionally, as the world looks to cope with the new normal, hybrid models with virtual and in-person care will grow more commonplace as homecare, concierge medicine, traditional providers, and national retailers compete to deliver low-cost high-quality healthcare. As companies like Brightline and Zerigo Health have demonstrated, such approaches to care can enhance experiences, improve outcomes, and decrease costs.

#4 Closing the Gap – The industry will address health inequities by prioritizing and integrating culturally competent care

In response to the imbalances in access to care and clinical outcomes, digital health companies are primed to support healthcare stakeholders with tools to address social determinants of health. Live Chair Health, for example, is decreasing health care disparities found among people of color by meeting people where they are, in the communities they live, and at places they trust, including barbershops, hair salons, and churches.

With social determinants of health, racial disparities in health, and challenges in health literacy top of mind across the industry, stakeholders will also look to close care gaps by delivering culturally competent care. This includes increasingly focusing on providing vulnerable populations with access to a holistic set of solutions. For example, ConsejoSano partners with health plans to deliver an insight driven, personalized member experience through culturally and linguistically aligned member engagement.

#5 Home Sweet Home – The future of healthcare will shift back to the home.

Largely driven by COVID-19, the aging population and the rising prevalence of chronic disease, the future of healthcare will largely shift to the home. This shift will extend from low-acuity urgent care visits to higher-acuity long-term care such as hospital in the home and continuous preventative care for the elderly, economically vulnerable, or people with multiple chronic conditions. For example, MedArrive leverages a technology-enabled care delivery solution driven by a network of EMS providers to bring affordable at-home care to vulnerable populations across the country.

Companies are also responding to the needs of the aging population by providing blended virtual and at home care that expands beyond traditional clinical care. As companies like Homethrive have demonstrated, the market is ripe for such technologies to support both the aging population and their caregivers.

#6 Is There a Doctor in the House? – Healthcare supply will shift to better fit demand via staffing and virtual solutions

As provider shortages continue to rise, demand will be better met with the help of virtual solutions and new staffing models. Driven in part by delayed procedures and growing mental health issues, stakeholders across healthcare will more broadly leverage innovative staffing and delivery solutions that up-skill the non-clinical workforce to meet the demand.

Companies like RecoveryOne are strategically leveraging human-connected care and technology to offer home-based, recovery-focused virtual physical therapy. Others like CirrusMD leverage a chat-first model, connecting individuals to providers in under 60 seconds and can resolve encounters in a matter of minutes. Additional examples of innovative staffing models include coaching models, peer counselors, or trained community members.

#7 Value Comes in More Than One Form – Startups will seek a combination of capital and strategic partners to scale

The influx of capital pouring into the digital health market continues to drive headlines. However, building and scaling companies in healthcare is complex and requires a deep understanding of the industry and navigational support, especially when engaging with incumbents. Capital is just one of the many assets required for success. Successful healthcare companies also need strategic guidance, operational experience, and introductions to high-value relationships.

At 7wireVentures, we believe deep industry expertise, a strong network, and boots-on-the-ground operations support will continue to deliver outsized value for companies in 2022 and beyond. A partner that is strategic, that can help companies with operations, assist with business development, and provide a path forward for them in a market as complicated as healthcare is as important as capital itself.

We are excited about the future of the digital health market and the opportunities that exist for the industry to empower Informed Connected Health Consumers with the knowledge and resources to maintain their own health, and, at a system-level, enable a stronger, more resilient healthcare ecosystem that achieves better outcomes at a lower cost. We look forward to continuing to partner alongside entrepreneurs in 2022 and beyond to build companies that truly change the healthcare experience for all of us as consumers.