Perspectives

Rethinking Consumer Health and Care: The Role of Digital Health in Neurodegenerative Diseases

Neurodegenerative diseases (NDs) damage and destroy parts of one’s nervous system, specifically the brain, severely impacting a person’s cognitive ability or motor skills. As the disease progresses, patients lose the ability to live and manage independently. Despite decades of research, there is still no cure available for these conditions. At best, consumers can hope to treat symptoms. As a result, NDs pose a significant burden on consumers living with these conditions, their loved ones, and the health system at large. The direct financial cost of Alzheimer’s and other dementias alone was estimated at $345B in 2023, and caregivers provided an estimated 18B+ hours of unpaid care. Those afflicted often struggle to receive information about their conditions and do not know where to turn to for help. Layering these challenges with the shortage of specialists that focus on treating cognitive disorders makes it acutely evident that many consumers are likely left in the lurch when attempting to manage their conditions.

Additionally, the challenges associated with ND management are increasing. Age is the main indicator of when these diseases surface, and as our population is living longer, the number of Americans with neurodegenerative diseases is also rising rapidly. As a result, the number of Americans with Alzheimer’s and other dementias is expected to triple by 2060. Hispanic and Black Americans are expected to see the largest increases, of 7x and 4x respectively. Both Alzheimer’s and MS disproportionately impact women – women are 2x more likely to be affected with Alzheimer’s and 4x more likely to be affected with MS. Parkinson’s and ALS, on the other hand, disproportionately impact men.

Pharmaceutical and biotech companies are investing in developing treatments for these conditions, but recent advances in treatments have had less-than-smooth rollouts, facing challenges with efficacy and patient uptake. These challenges are exacerbated by the high costs of these treatments. Leqembi, the most recently approved Alzheimer’s drug, is estimated to cost over $26K annually, while Relvyrio, a treatment for ALS, is estimated to cost $158K annually.

Long-term success of these therapeutics relies on a provider’s ability to effectively identify eligible patients, titrate dosage, and monitor outcomes. However, the noted shortage of specialists coupled with the growing disease burden has forced primary care physicians (PCPs) to play an outsized role in the diagnosis, treatment, and ongoing management of patients living with neurodegenerative conditions. However, these physicians are largely not set up for success, with 87% of PCPs reporting little or no training in dementia diagnosis or care. Further, 39% of PCPs cite a lack of comfort diagnosing and managing Alzheimer’s and other neurodegenerative diseases. The prevailing reticence of PCPs in attempting to diagnose NDs meaningfully threatens consumer access to much-needed treatments.

In response to the challenges that exist today, regulators are actively searching for new opportunities to mitigate costs while better enabling consumers to manage their care journeys. To support increased ND diagnoses, payers are updating inclusion and diagnostic criteria, enabling patients to access the right testing and treatments at the right time. For example, in October 2023, CMS lifted the longstanding national coverage determination that restricted patient access to PET scans related to Alzheimer’s. Further, in July 2024, CMS will launch an alternative payment model, GUIDE, for dementia patients, aimed at assisting individuals living with dementia without a paid caregiver. This model aims to curb Medicare expenditures, alleviate burdens shouldered by caregivers, and enable consumers to age gracefully at home. Despite increased regulatory attention and improved reimbursement pathways for neurodegenerative disease care, the incumbent system still is not set up to effectively take advantage of new therapeutic developments.

Digital health technologies can help alleviate many of the hurdles that exist throughout the ND care journey. Stakeholders across the healthcare continuum are actively working to deploy new technologies to address the nation’s growing ND challenge. Physicians are partnering with innovative companies to build dementia care solutions, implement new digital cognitive assessments, and deploy wearable devices to remotely monitor patients and intervene as needed. Health plans, though still early in employing virtual ND clinics, are working with digital musculoskeletal (MSK) solutions to address diseases that impact motor function. Consumers have leveraged digital health tools to support care plan adherence, and caregivers have been able to access coaching, community engagement, and mental health support through digital technologies.

Though all individuals that live with NDs face tremendous challenges, consumers’ specific health needs vary based on age and stage of diagnosis. To best outline neurodegenerative care gaps, 7wireVentures categorizes ND consumers into four distinct segments: Proactive Preventors, Silent Strugglers, Ready Adapters, and 24/7 Sufferers.

The unique characteristics of these consumer segments demonstrate consumers’ diverse needs across levels of disease acuity and the consequently varied approaches to care required to meet these health needs. With more intentional design and innovative technologies, the neurodegenerative care journey can be reimagined to empower consumers to receive timely, personalized, comprehensive care.

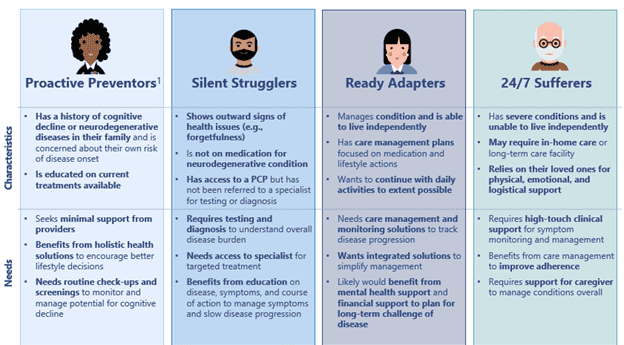

Neurodegenerative Disease Digital Health Landscape

From tools for patient engagement to neurostimulation devices, investor interest in neurodegenerative disease management has grown. Between 2020 and 2023, total investment exceeded $3B, with 2021 alone seeing a staggering $1.5B in private investment.1 We believe the neurodegenerative care market landscape can be segmented into six different categories: Patient Engagement, Diagnostics & Biomarkers, Virtual PT, Caregiver Support, Clinical Care Management, and Neurostimulation.

[1] Pitchbook

Patient Engagement: Digital health solutions can help patients manage complex care treatment protocols, improving medication and treatment plan adherence while also offering a support system for both consumers and their caregivers. Companies are taking varied approaches to ensure consumers adopt recommended changes in behavior. MapHabit, for example, organizes tasks into visual guides, creating step-by-step maps to help members complete daily activities on their own. Together Senior Health, on the other hand, creates an integrated digital community for dementia patients, which helps reduce feelings of social isolation while collectively building better habits.

Diagnostics & Biomarkers: One key challenge for consumers is obtaining a timely, accurate diagnosis for neurodegenerative diseases. Primary care providers are often not comfortable performing ND assessments, and in the case of Alzheimer’s in particular, consumers may not be aware of their symptoms until the disease has already progressed significantly. Further, existing tests are often time-consuming and costly. Digital health companies are developing innovative ways to detect and monitor neurodegenerative diseases in convenient and low-cost ways. Neurotrack has developed rapid digital screening tools that can be integrated into annual wellness visits or performed from the consumer’s home. Based on a member’s diagnosis, the company provides access to personalized behavior change programs and educational materials to support their care journey. Linus Health developed a digital cognitive health screening tool rooted in a long-studied assessment for detecting cognitive impairment. The company also develops provider reports and generates personalized patient action plans to help drive changes in behavior.

Virtual PT: Consumers struggle to access face-to-face time with motor specialists to support rehabilitation; only 9% of people with Parkinson’s received care from motor disorder specialists. Virtual physical therapy solutions help expand and improve access to rehabilitation from the comfort of people’s homes. These tools also leverage advanced motion tracking technologies to ensure consumers are correctly performing the recommended exercises and to track and monitor improvements in motor skills. 7wire portfolio company RecoveryOne offers digital MSK services including a personalized care plan and health coaches that keep patients motivated along their recovery journey. The company also offers care navigation tools, aiming to reduce the wait time at the start of the MSK care journey. Consumers using RecoveryOne were 51% less likely to have costly surgeries and saw noticeable pain relief in just 9 days. MindMaze offers game-based digital therapies that promote movements that would typically be practiced with a physical therapist, driving consumer engagement by gamifying the healing process.

Caregiver Support: Familial caregivers shoulder an enormous physical, emotional, and financial burden in supporting their loved ones with neurodegenerative conditions. 70% of the total lifetime cost for caring for someone with dementia is borne by families. These unpaid caregivers often face their own set of clinical and physical challenges, with 74% expressing concerns about maintaining their own health after becoming a caregiver. Digital tools can empower caregivers to address their own health challenges, provide a sense of social community, and assuage stress around delivering and managing the care that their loved ones need. 7wire portfolio company Homethrive offers tools to support aging-in-place by providing seniors and caregivers personalized insight, advice, and validated resources for non-clinical services. The company’s 24/7 on-demand digital resources and network of expert care guides simplify the care journey for both patients and caregivers. Homethrive’s care guide interventions demonstrated an ability to reduce falls by 20% among high-risk patients – a meaningful outcome for those with NDs given the high rate of falls among the population. Kinto offers AI-driven care coaching services featuring expert advice, individualized homework, and group learning and support. The company’s focus on building community ensures caregivers have access to each other for peer-to-peer support.

Clinical Care Management: Clinical care management organizations leverage telehealth to streamline the diagnostic process as well as provide access to specialized expertise for patients and caregivers. Virtual care teams enable real-time monitoring of patient conditions, with the ability to escalate for greater support as needed. These virtual clinics empower patients and their caregivers to manage symptoms, optimize daily routines, and improve overall quality of life. Synapticure provides access to virtual care for both individuals and caregivers using neurologists, mental health providers, and care navigators. The company addresses a range of neurodegenerative conditions, including Alzheimer’s, Parkinson’s, and ALS. To address a crisis of unmet mental health needs among seniors with dementia and their family caregivers, Rippl Care has built a multidisciplinary network of care navigators, nurse practitioners, and licensed social workers. Rippl’s care team walks alongside members and their loved ones, providing care navigation, education, medical care, and counseling options. Remo Health offers care navigation and a network of dementia specialists to assist in diagnosis, ongoing care, and patient and caregiver support and education.

Neurostimulation: Companies are developing new devices that leverage neurostimulation to help manage neurodegenerative conditions. Neurostimulation uses electrical impulses which stimulate the nervous system, allowing patients to compensate for forms of nerve damage. Some of these devices can detect and classify brain signals while delivering neurostimulation treatments, providing physicians with enhanced data for clinical decision-making. Cognito Therapeutics uses a non-invasive visual and auditory stimulation device to induce gamma brain waves, increasing patient’s protein expression and reducing the incidence rates of amyloid plaques, a key factor in Alzheimer’s and other dementias. Nalu Medical uses electrical impulses to interrupt brain signals, helping patients alleviate nerve pain associated with Parkinson’s and other central nervous system related disorders.

7wireVentures Predictions

PREDICTION 1: Companies will work to build out digital solutions that streamline the diagnosis to treatment pathway.

Consumers face a multiplicity of challenges in accessing disease-modifying therapies. Chiefly among them is the lack of timely diagnosis and information about NDs. Challenges with diagnosis include access to specialists and high-cost imaging tests. Payers and providers will partner with virtual care platforms that demonstrate an ability to effectively improve early detection and seamlessly integrate diagnostics into existing care workflows. As more treatments become available, regulators and health plans will seek to thoughtfully expand coverage to an array of novel testing methodologies and therapeutics. In parallel, stakeholders will also continue to innovate and develop testing modalities that simplify and streamline the diagnostic and medication titration process. These tests will incorporate advanced machine learning algorithms to enable more targeted dosing based on specific disease status among other salient clinical history and biometric data points.

PREDICTION 2: Payers will partner with companies who can accurately identify patients most likely to benefit from novel treatment, ensure care plan adherence, and reduce overall cost of care.

Given the $1 trillion cost of Alzheimer’s estimated by 2050, it is imperative that health plans innovate to reduce the cost of care for members with NDs without compromising on outcomes. As such, we expect an increase in the development and adoption of scaled value-based care solutions incorporating enhanced care navigation, coordination, and care plan adherence. The new alternative payment model (GUIDE) launched by CMS this year will facilitate the entry of new organizations into the dementia care space and drive the need for digital health partnerships for those at risk for the cost of care. As the GUIDE model evolves, we expect increased investment and greater standardization in health plans’ dementia care management strategies.

PREDICTION 3: Solutions that alleviate caregiver burdens and enable greater workforce participation will see increased funding.

As the patient population with neurodegenerative diseases grows, so too will the number of people required to assume caregiving responsibilities. Today’s state of caregiving often requires people to drop out of the workforce, and two-third of caregivers are women. As employers seek to retain talent and promote equity, benefits leaders will seek out solutions that both support caregivers’ ability to care for their loved ones while enabling them to stay productive in the workforce. Additionally, an increased emphasis will be placed on solutions that include elements of behavioral health support for caregivers. Finally, pharmaceutical companies will recognize the role caregivers play in supporting patient access to new treatments and will place a greater emphasis on caregiver engagement to facilitate recruitment for clinical trials.

PREDICTION 4: Digital therapeutic and AI-driven approaches to care will gain traction to fill the specialist gap.

The shortage of neurologists and geriatricians means providers will need to find ways to expand the panel size clinicians are able to reach. AI-based screening and conversation tools will be deployed to assess and monitor patients, serving as the first line of defense. Given the high cost, side effects, and limited eligible population of current treatments, organizations will also look toward the potential for digital therapeutics. As neurostimulation devices advance in development, we expect to see an uptick in overall use. We also expect growth in the use of gamified techniques that improve adherence and help slow progression of cognitive decline. Finally, AI-based remote monitoring will continue to be leveraged to support patients with lower acuity conditions and enable aging in place.

We have conviction that digital health solutions can be deployed to reimagine the end-to-end consumer care journey for those with neurodegenerative diseases. The road will not be easy, but collaboration between investors, payers, providers, pharma, and policymakers can enable consumers and their families to take control of their diagnostic and treatment journeys, improving the overall health and care experience.