Perspectives

Empowering Underserved Americans: Revolutionizing Medicaid Care Through Digital Health Solutions

Embedded within the intricate framework of American healthcare, Medicaid is the country’s largest insurer, providing essential support to 28% of Americans (up from 18% in 2010). Its financial footprint drives 44% more expenditure than the commercial sector, amounting to $728B in annual health expenses.

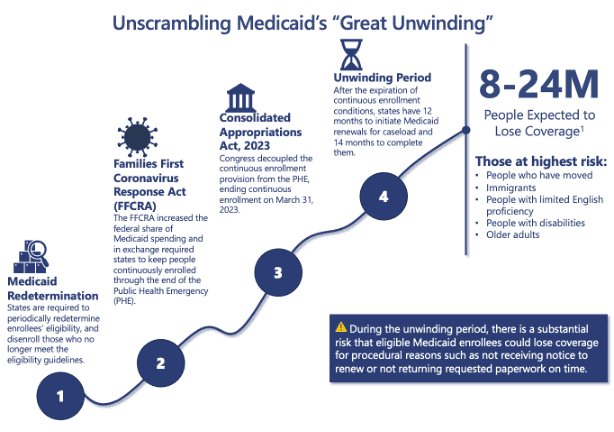

Over the last decade, the notable increase in coverage resulted from the expansive reach of the Affordable Care Act (ACA). Medicaid coverage now extends to all nonelderly adults with income levels up to 138% of the federal poverty line (equivalent to $14.5K for individuals). In 2020, the Families First Coronavirus Response Act (FFCRA) and the Public Health Emergency (PHE) declaration ensured continuous Medicaid coverage, dispelling consumer bias on the gaps in Medicaid care.

Medicaid serves a diverse demographic: 49% of births, 8M elderly adults, and 14M individuals in rural areas. Medicaid plays a pivotal role in women’s maternal and mental health, covering two-thirds of adult women during their reproductive years and assisting a quarter of women facing mental health concerns.

Yet, systemic barriers persist, hindering access to care. An overwhelming 92% of beneficiaries find their health plan information perplexing and Medicaid enrollees are twice as likely to have limited English proficiency. Additionally, Black women experience a pregnancy related mortality rate three times higher than their white counterparts, primarily due to limited access to quality care and education. Furthermore, those who live in rural areas are 2.5x farther from a hospital than those who live in urban areas. Contrary to conventional assumptions, beneficiaries constitute a demographic where 80% are actively employed, 30% devote their time to caring for their homes and families, and the majority do not receive cash welfare.

Understanding the diversity of backgrounds and contexts of Medicaid beneficiaries provides a more nuanced perspective, highlighting their active engagement in various facets of society beyond healthcare, and underscoring the importance of tailored support to address their unique needs. Digital health solutions have the opportunity to support these individuals by dismantling these barriers and creating an inclusive and equitable healthcare system that truly serves all members of our community.

However, with changing regulations, an estimated 8-24 million beneficiaries may lose access to Medicaid, particularly recent movers, immigrants, those with limited English proficiency, and the elderly. Eligible Medicaid recipients are at risk of losing coverage due to missed renewal notices or delayed paperwork.

At 7wireVentures, we see a unique opportunity to support the Medicaid population through digital health applications, expanding care, enhancing access, and redefining the consumer experience. The landscape is evolving, with new players coming to market, offering platforms tailored for specialized and preventative care, serving a specific demographic, and embracing virtual and in-person modalities.

Medicaid Landscape

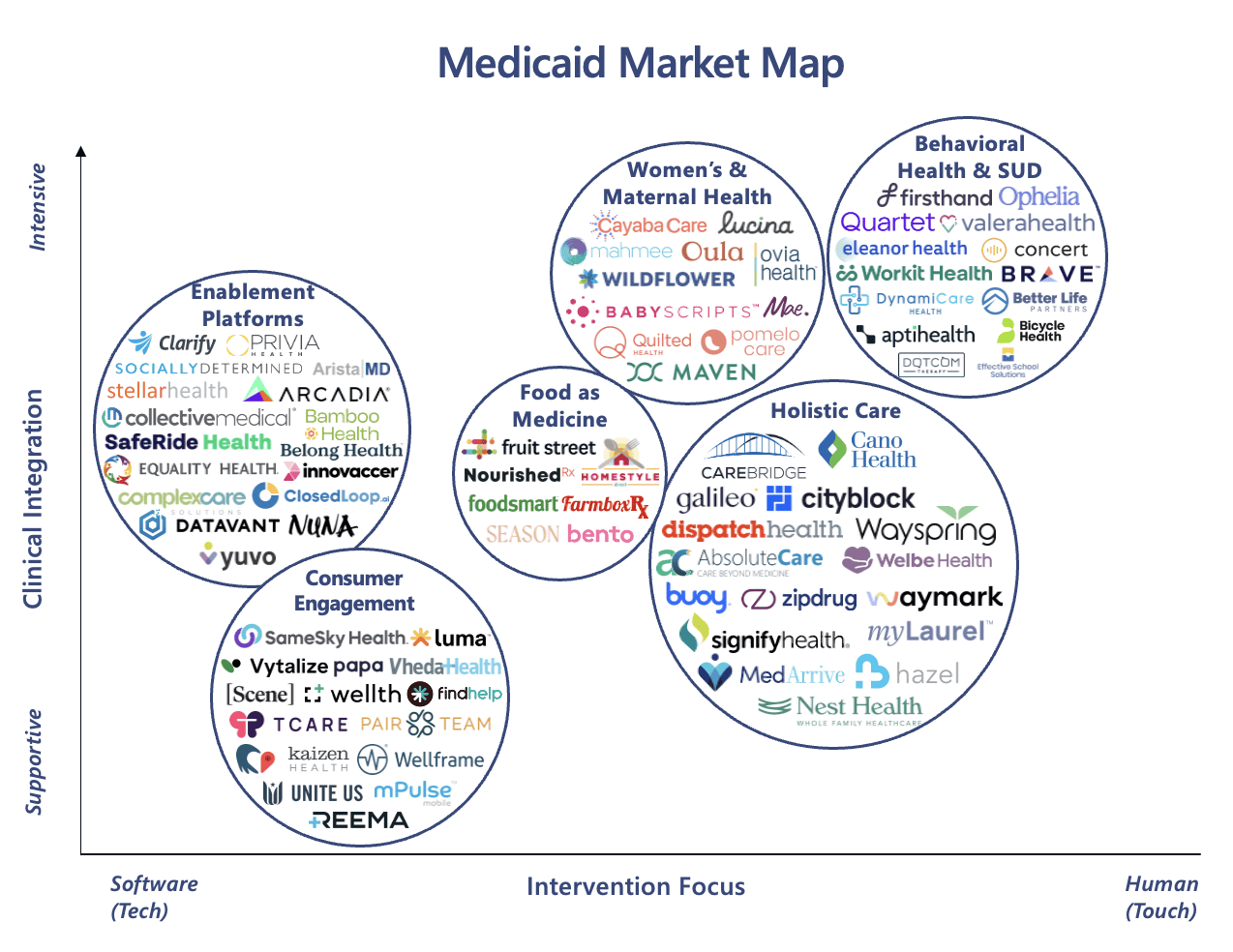

From enablement platforms to holistic care, investor interest in Medicaid solutions has grown. Between 2020 and 2022, investment reached over $11B, but investment in Medicaid solutions is also in line with the lower investment levels across the general market. In 2020, investment in Medicaid solutions reached a staggering amount of $2.5B.[1] We believe the Medicaid market landscape can be broken out into six different categories: Holistic Care, Consumer Engagement, Behavioral Health & SUD, Women’s & Maternal Health, Food as Medicine, and Enablement Platforms.

Holistic Care: Medicaid recipients, particularly those in rural areas, face a shortage of primary care and mental health providers and could benefit from accessible virtual and in-home care. Also, Managed Care models can help curb costs and reduce emergency department admissions by 28% . MedArrive, a 7wireVentures portfolio company, extends care into the home via EMS professionals, reducing ED utilization by 20%. Homeward Health, caters to aging rural communities with tailored virtual, at-home, and community-based care. Another company, SignifyHealth, employs integrated in-home assessments and analytics for efficient preventative care, providing a comprehensive patient health overview.

Consumer Engagement: Diverse populations stand to benefit from multilingual and culturally sensitive platforms. A 7wireVentures portfolio company, SameSky Health, has created a cultural engagement platform that fosters meaningful relationships, guiding individuals toward essential healthcare services. This has led to a 4x increase in the likelihood of Black members attending an Annual Wellness visit. Luma Health, is another Medicaid focused company paving the way towards multilingual care, connecting patients with providers fluent in their language and meticulously coordinating each step of the care journey to meet each patient’s unique needs.

Behavioral Health & Substance Use Disorder (SUD): Medicaid, the largest payer for SUD services, offers an optimal platform for utilizing digital health therapy and continuous social worker support to reduce the need for costly inpatient care. Notably, 36% of Medicaid adults with moderate to severe SUD report fair or poor health, double the rate of their counterparts in the commercial sector. Additionally, a staggering 46% of children in Medicaid or CHIP who experience depressive episodes do not receive behavioral health treatment. Digital solutions like Quartet Health, conduct thorough screenings and connect at-risk members with suitable mental health providers. Another company, Eleanor Health, provides evidence-based care plans for SUD recovery, including medication-assisted treatment, coaching, telehealth consultations, and expert oversight for comprehensive well-being.

Women’s & Maternal Health: The growing need for women’s and maternal healthcare, especially in rural and culturally diverse communities, is driving the development of innovative care options. Over 50% of rural counties lack hospital-based OB/GYN services. Given Medicaid is the largest payer for BIPOC births, digital solutions can aid Medicaid providers in culturally sensitive care. Companies like Wildflower Health are pioneering mobile maternity programs using self-reported data to identify high-risk pregnancies for timely intervention. Additionally, Babyscripts and Quilted Health connect women to resources and offer virtual and in-person support throughout prenatal and postpartum phases, guided by midwives.

Food as Medicine(FAM): Medicaid organizations can proactively cut downstream costs by addressing chronic conditions, with studies showing a 31% decrease in monthly healthcare expenses for patients in nutritional programs. This highlights the importance of beneficiaries accessing ‘Food as Medicine’ initiatives and a robust food security system. Ten states have gained approval or pending waivers to use Medicaid benefits for essential food services, a milestone under Medicaid’s 1115 waiver program. Digital solutions like Foodsmart, for personalized nutrition plans and meal ordering, and Fruit Street for diabetes prevention through virtual classes and dietitian access, signal a market shift towards tailored nutritional programs for Medicaid recipients.

Enablement Platforms: Software solutions designed to enhance and streamline aspects of care delivery, prediction, and administration have the potential to transform care for the Medicaid population, as 32% of expenditures from those with multiple chronic conditions could be reduced by population management and risk analysis solutions. Innovaccer and Arcadia offer platforms integrating consumer and health data for holistic patient views, risk prediction, and coordinated care. Companies like Clarify employ advanced analytics to map patient care journeys, make clinical recommendations, and identify high-risk patients for more effective care decisions.

7wireVentures Predictions

PREDICTION 1: Medicaid providers are witnessing a surge in beneficiaries with chronic care conditions and mental health needs. Health systems will integrate Specialist and Psychiatrist care into the Medicaid journey, driving demand for tailored solutions.

Providers and Managed Care Organizations will increasingly use predictive analytics, data sharing, and interoperability to track patient trends in chronic care, shaping policy and refining programs. Medicaid’s shift towards value-based care will prioritize prevention and cut costly acute episodes. Simultaneously, a new wave of digital health companies will offer vital long-term care for those with chronic and psychiatric conditions. These solutions will take a proactive approach, including regular monitoring, prevention, and patient education, reducing reliance on sporadic visits. With a growing prevalence of complex conditions, MCOs must innovate to expand provider networks, possibly through partnerships with digital health firms offering tools like Digital Therapeutics and virtual care models.

PREDICTION 2: As Medicaid projects demonstrate the effectiveness of services extending beyond clinical care to impact broader social determinants of health, states will further integrate SDOH benefits. Innovative companies will increasingly collaborate with local, community-based organizations to meet consumers where they are.

As the healthcare landscape evolves, collaborative partnerships between health systems, MCOs, and CBOs will gain prominence. CBOs will maintain their pivotal role providing touchpoints and offering essential life services. The growing demand for health equity and deeper collaboration with CBOs may drive the expansion of healthcare infrastructure, potentially leading to the establishment of new clinics or outreach centers. In response, we anticipate companies will facilitate partnerships between CBOs and health systems through digital solutions, including data platforms, care coordination tools, and communication resources, all designed to ensure efficient service delivery. Larger health systems will closely monitor these developments, extracting valuable insights that may lead to strategic acquisitions.

PREDICTION 3: The growing awareness of racial disparities in maternal health, along with federal initiatives to enhance pregnancy-related coverage for Medicaid beneficiaries, will lead to the emergence of tailored digital health platforms meeting the comprehensive needs of both mother and child.

The progression of maternal Medicaid coverage will bring forth personalized care models, going beyond conventional episodic methods. This will be achieved by addressing both medical and social needs through collaborations with community organizations, mental health services, nutrition programs, and educational resources. However, due to the state-by-state nature of Medicaid, those states not expanding will create a glaring disparity in maternal coverage. Digital solutions will step in to broaden coverage, utilizing mobile apps, wearables, and telehealth to improve access, enable remote monitoring, and facilitate virtual consultations, thereby strengthening the connection between mothers and healthcare providers.

[1] Pitchbook