Perspectives

Turning Lifespan into Healthspan: The Future of Longevity

Modern healthcare is under growing pressure to evolve. Longer life expectancies, rising rates of chronic disease, and a widening disconnect between consumer expectations and traditional care models are driving the need for change. In this context, the emerging longevity sector offers a new lens through which to rethink health. Rather than focusing solely on lifespan, longevity emphasizes healthspan—the number of years individuals remain healthy and active. Through advances in diagnostics, biotechnology, therapeutics, AI, and digital health platforms, this field aims to slow, prevent, and even reverse age-related decline.

Interest in extending life has persisted for many centuries, but the modern longevity movement began in earnest in the 2010s with biotech pioneers like Unity Biotechnology and Juvenescence, alongside consumer health platforms such as WHOOP and Fitbit. In the 2020s, momentum accelerated across consumer diagnostics, therapeutics, and cellular rejuvenation. With 1 in 6 U.S. adults now over the age of 65 , 42% of the population actively managing at least one chronic condition, and 70% of Americans believing that the healthcare system doesn’t meet their needs it makes sense that there is demand for solutions that work proactively to enable individuals to live healthier lives as opposed to reactive solutions that manage conditions once symptoms already appear.

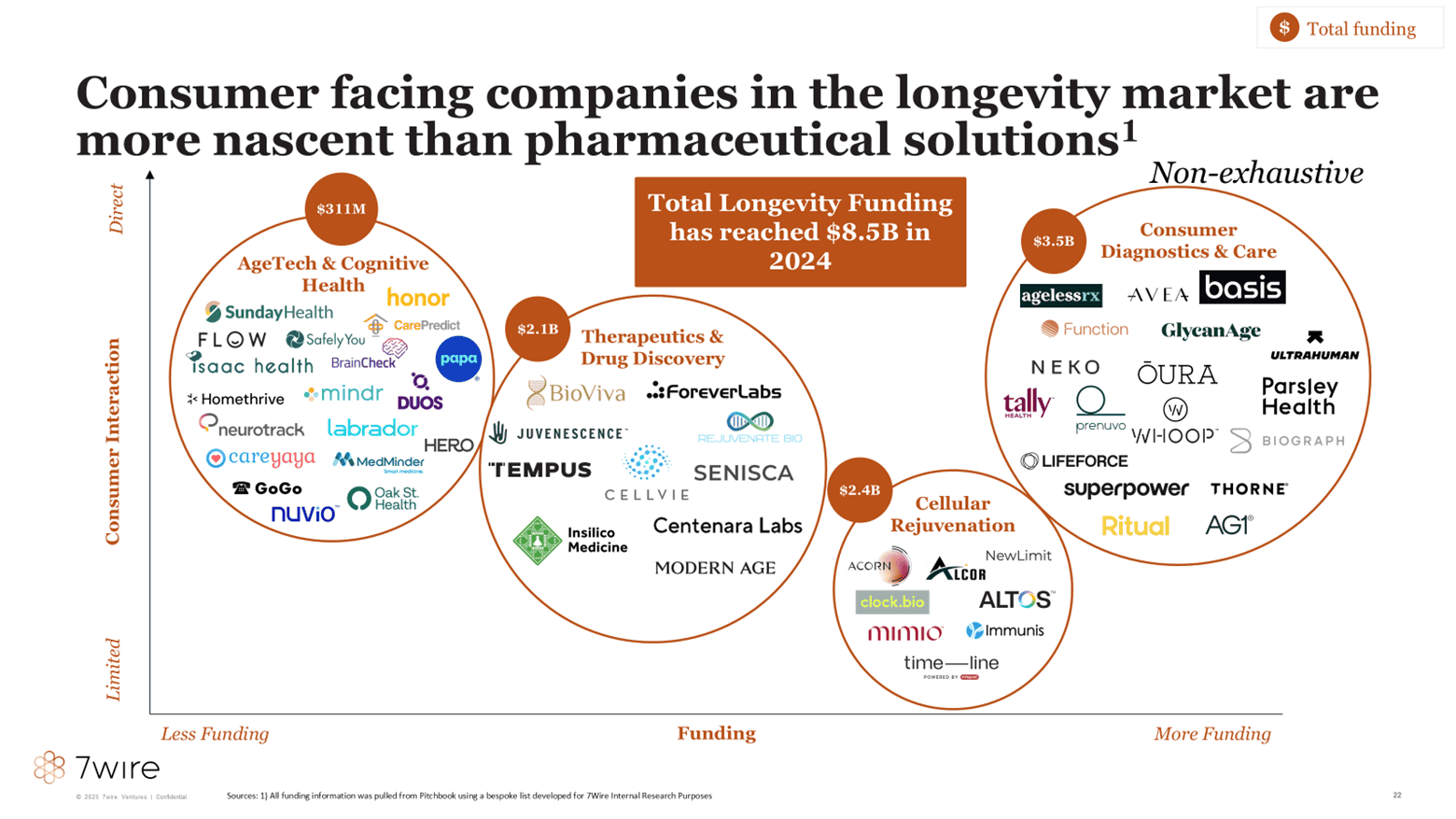

In 2024, longevity-focused startups attracted $8.5B in venture capital. The market—spanning anti-aging therapeutics to wellness tech—is expected to grow from $5.3T in 2023 to $8T by 2030. Yet, despite growing consumer and investor interest, challenges remain. Today’s payment models largely reward disease treatment over prevention. Additionally, aging is not recognized as a disease by regulators, limiting reimbursement pathways. Unlocking this market will require rigorous, clinically validated outcomes that demonstrate both consumer benefit and cost savings.

Stakeholders Priorities & Partnerships in Longevity

The longevity market is quickly evolving at a time when populations are aging and healthy life expectancy lags behind total lifespan. Yet, stakeholder engagement in longevity remains uneven. A few stakeholders are doubling down on the potential of extending healthspan, while others hesitate without clear evidence, incentives, and regulatory clarity.

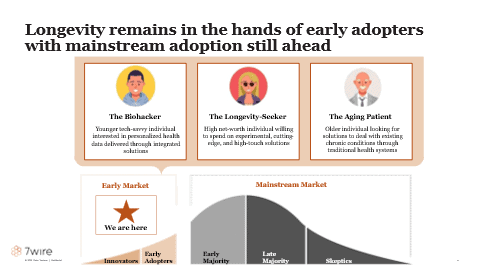

Consumers are the “demand side” of the longevity market with varying priorities. Early adopters (biohackers, longevity-seeking health enthusiasts, and aging patients) are already spending out-of-pocket on longevity services to extend their healthspans. However, the average, older consumer remains cautiously skeptical, finding it hard to distinguish science from anti-aging hype. Cost, lack of health plan coverage, and the effort required for lifestyle changes limit mainstream uptake. Consumer engagement today is most evident in rising wellness trends, enabled by direct to consumer (DTC) diagnostic and biometric companies that drive both data and demand generation for the market as a whole. Consumers want to age well (77% of older adults want to age in place, and nearly half of Americans are willing to spend time ensuring they live as long as possible), but they will need affordable, proven solutions and guidance to embrace longevity innovations.

Providers want to improve outcomes by managing aging-related conditions more proactively, but many remain cautious, lacking training in longevity medicine, official guidelines, or FDA-approved therapies. Some innovative groups are experimenting, such as Rush’s Center for Excellence in Aging that integrates specialties to optimize longevity, but mainstream engagement is limited and reactionary. With better evidence and reimbursement, providers could shift towards preventive longevity care as the new paradigm.

Employers/Payers view longevity as a classic paradox. Keeping members healthier longer should reduce long-term costs, but employers/payers are hesitant to invest in preventive longevity programs when payoffs are uncertain and distant. There is no billing code for “aging reversal” and most interventions are paid out-of-pocket. Without regulatory recognition of aging as a treatable condition, payers lack a foundation to reimburse longevity interventions. The potential is significant: if outcomes data can unlock contracts with health plans, payers could one day cover longevity services the same way they cover chronic disease management. For now, most payers remain observers rather than leaders in the longevity space.

Pharmacy Benefit Managers (PBMs) control medication formularies and will significantly influence the proliferation of any future anti-aging drugs or supplements. Currently, they are largely uninvolved since there are no drugs explicitly approved for aging as a condition and Return on Investment (ROI) measures are unproven, although trials like Targeting Aging with Metformin (TAME) may help push regulators towards recognizing aging as an indication. PBMs currently focus on traditional chronic disease meds and managing the cost of care. But, in a future state, PBMs could play a pivotal role in negotiating coverage criteria. Once longevity therapeutics reach the market, PBMs will decide if and how to include them.

Pharmaceutical Companies see longevity as a new frontier for drug discovery and want therapies that target the biology of aging to address multiple age-related diseases, tapping into an enormous market. For example, Novartis struck a $550M collaboration with BioAge to identify drug targets to slow aging. While pharma interest in geroscience is growing, most firms remain in exploratory stages, funding small R&D teams with a limited pipeline of early trials. Robust pipelines of FDA-approved “longevity therapeutics” will accelerate the flywheel of longevity development across stakeholders as pharma enthusiasm (and investment) continues.

Longevity in Healthcare Landscape

The longevity market can be segmented across 4 key categories: Agetech & Cognitive Health, Therapeutics & Drug Discovery, Cellular Rejuvenation, and Consumer Diagnostics & Care, totaling ~$8.4B in total funding in 2024.

Consumer Diagnostics & Care ($3.5B): This segment empowers individuals with tools to measure and manage their aging trajectory, through diagnostics, biomarkers, and continuous monitoring. Superpower Health, which raised a $30M Series A, offers at-home testing kits that assess key longevity biomarkers such as inflammation, metabolism, and cellular health. The platform provides personalized insights and science-backed lifestyle interventions, and ships curated supplements designed to improve biological age and long-term healthspan. This segment of the longevity market is 7wire’s primary focus and is the most directly tied to our thesis of the Informed, Connected Health Consumer.

Select Case Studies:

Function Health offers a comprehensive, membership-based platform for proactive health management, combining over 100 lab tests with personalized insights to help individuals understand and optimize their long-term health. Members receive data-driven recommendations based on deep biomarker analysis spanning key areas like cardiovascular, metabolic, hormonal, and immune health. With nearly 50,000 paying members enrolled and over 200,000 on the waitlist, Function Health is demonstrating significant demand for preventive, data-driven care

Parsley Health, a 7wire Ventures portfolio company, combines advanced diagnostics, functional medicine, and lifestyle coaching in a subscription-based primary care model that has shown results. 85% of patients achieved symptom relief, and employer clients reported an ROI of 2:1 within the first year, largely through reduced chronic disease burden and fewer specialist visits. Parsley’s model, backed by payers and employers, shows that proactive, root-cause-focused care can yield tangible health benefits and cost savings, serving as a strategic beacon for scalable longevity-focused healthcare.

Maven Clinic + Oura have partnered to integrate continuous biometric data into its virtual care platform for women’s health, spanning fertility, maternity, and menopause care. Eligible members can sync their Oura Ring data, helping Maven clinicians monitor health trends and initiate early, personalized interventions (like addressing gestational diabetes or menopause-related sleep disturbances) based on real-time insights. According to Maven’s internal survey, 73% track their health regularly and 45% review their data daily, with over half willing to share it with a provider. This partnership demonstrates how integration of consumer wearables into clinical workflows can deepen personalization and timeliness of care.

AgeTech & Cognitive Health ($311M): While AgeTech refers broadly to technology designed to support aging populations, when viewed through the lens of longevity, AgeTech becomes preventive with a proactive focus on slowing or reversing aging related issues. For example, Neurotrack, a digital health company that specializes in rapid, clinically validated cognitive assessments for early detection of cognitive decline. Rather than directly servicing symptomatic elderly patients, Neurotrack targets middle-aged and older individuals for early interventions aligning with a longevity-focused preventive aim. This is a space that 7wire is actively evaluating opportunities in.

Homethrive, a 7wire portfolio company, offers an AI-enhanced, high-touch caregiving support platform delivered through employers and health plans. They combine 24/7 digital navigation tools with dedicated Care Guides—licensed social workers—for personalized coaching, concierge coordination, and assistance across the full spectrum of caregiving needs, including eldercare, backup childcare, chronic disease support, and Medicare guidance

Therapeutics & Drug Discovery ($2.1B): Companies in this space are focused on developing drugs, biologics, and gene therapies to slow aging or treat age-related diseases at their root causes. Many of these treatments function by intervening in fundamental aging mechanisms and utilize technology like Artificial Intelligence to improve development processes. Companies like BioAge Labs are using AI and longitudinal human data to identify drug targets that affect aging.

Cellular Rejuvenation ($2.4B): Players in this space are building on the work in the Therapeutics & Drug arena and taking it a step further by reprogramming biology to reset or restore aged cells to a more youthful state, reversing aging markers, improving tissue functions, and restoring regenerative capacity. For example Altos Labs – which has secured $3B in funding from investors like Jeff Bezos – is making strides in partial reprogramming of cells and improving metabolism as a key component of cellular resilience.

7wire Predictions

- A new wave of tech-enabled solutions that focus on reversing or delaying aging will help individuals preserve independence for longer.

New innovations and technologies will move beyond simply extending lifespan to actively preserving function and autonomy. Personalized longevity programs — informed by biological age, omics data, and individual risk profiles — will become a standard offering in employer-sponsored and payer-funded benefits. These will integrate virtual care, fall prevention, mobility training, and cognitive support into a unified AgeTech ecosystem. Solutions will evolve into multi-dimensional platforms that blend physical health, social connection, and purpose — offering virtual group fitness, social clubs, and community volunteering as therapeutic tools. As a result, “aging in place” will shift from a passive goal to an actively managed, tech-supported lifestyle.

- The outcomes data generated by these solutions will create the evidence flywheel that unlocks reimbursement and value-based contracts.

The first wave of longevity adoption will be powered by high-income, health-optimizing consumers willing to pay out of pocket for comprehensive programs. These early users will generate granular, longitudinal data from diagnostics, interventions, and behavioral tracking. With this real-world evidence, longevity solutions will begin to prove ROI on metrics payers and regulators care about: reduced hospitalizations, delayed onset of chronic disease, and lower long-term care costs. As this data accumulates, we will see the emergence of CPT codes, bundled payments, and value-based contracts, enabling reimbursement to scale adoption — turning longevity care into a recognized and reimbursable clinical domain.

- Once reimbursement scales adoption, continuous multimodal data will power hyper-personalized protocols that further amplify effectiveness for every stakeholder.

As longevity care becomes embedded in the health system, a new layer of continuous, multimodal data will emerge — combining wearables, at-home diagnostics, digital biomarkers, and omics. These data streams will feed real-time AI models that continuously refine individual care protocols, transforming longevity from a static plan to an adaptive health algorithm. Importantly, this infrastructure will require breakthroughs in interoperable data-sharing and privacy-preserving technologies. We’ll see platforms emerge that allow consumers to control, contribute, and monetize their data — turning them from passive recipients into active participants in their longevity journey. Over time, this will enable biopharma, providers, and tech players to collaborate in ways that accelerate preventive breakthroughs across the entire aging population.

Consumer longevity startups are uniquely positioned to reshape the healthcare landscape by driving demand through informed and empowered health consumers. As they demonstrate measurable improvements in health outcomes and cost-efficiency, they create a reinforcing cycle: evidence drives reimbursement, reimbursement fuels broader consumer adoption, and increased adoption generates even richer datasets for innovation. Ultimately, consumer longevity solutions will become a cornerstone of the overall longevity market, transforming healthcare from reactive disease management into proactive, personalized, and preventive care, which is a vision 7wire deeply believes in.